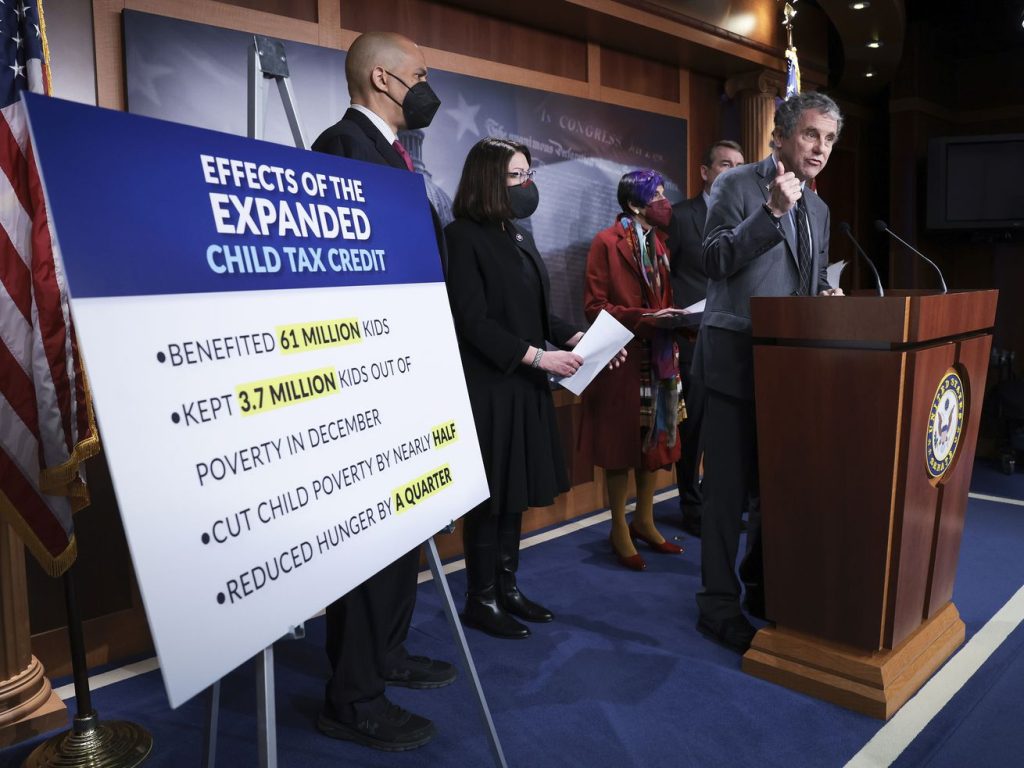

Sen. Sherrod Brown speaks at the Capitol on February 8 as members of Congress held a press conference about renewing the child tax credit and earned income tax credit. Brown has stated he’ll support no tax breaks for big corporations and the wealthy unless the child tax credit is included in the package. | Win McNamee/Getty Images

How Republicans’ disappointing midterm performance changed the politics.

In 2021, an expansion of the child tax credit delivered hundreds of dollars monthly to some 35 million parents across the United States, helping them afford gas, food, and school expenses, and lifting almost 3 million children out of poverty. But last December, Democrats narrowly failed to approve an extension of the expanded credit, and it expired.

Now, with only a few weeks remaining before a new Congress takes office, advocates for the child tax credit are trying again to get an expansion included in any end-of-year tax package.

It’s a tall order, especially because Democrats would need at least 10 Senate Republicans to agree to pass any broad deal; last year, even a simple Democratic majority proved out of reach. But Democrats believe the political dynamics have since changed in their favor, and so have their policy demands, making a compromise potentially easier for Republican moderates to stomach.

The sticking point since the expanded credit expired has been Republicans and West Virginia Democratic Sen. Joe Manchin’s resistance to the idea that a more generous child tax credit should go to families where no parents are working. 2021 marked the only time in its quarter-century history that the CTC had no parental work requirement, and it was that feature, experts agree, that drove the policy’s substantial reduction in child poverty: a stunning 46 percent drop in one year, according to US Census data. Until the Inflation Reduction Act passed in August, Democrats and their allies were unwilling to entertain any child tax credit expansion that maintained a connection to work.

Now, though, Democrats are signaling they’d embrace a more modest expansion — ideally one that keeps the credit fully available for all families, but at least makes it easier for parents with little to no earnings to access, even if at a reduced rate. Whether lawmakers can increase the amount of funding available for parents of infants and toddlers, as opposed to all kids under 18, is another option on the table.

The biggest negotiating card Democrats have right now is certain expiring business tax breaks. Since 1974, companies have been allowed to deduct research and development (R&D) spending the same year they make the investments, but as a budget gimmick included in the 2017 Tax Cuts and Jobs Act, businesses, as of 2022, now must expense those costs over five or 15 years instead. Restoring the right to annually deduct R&D spending is a top legislative priority of the business community.

Advocates are hoping to pair any restoration of R&D tax breaks with an extension of the child tax credit. In November, Democratic Sen. Ron Wyden, who chairs the Senate finance committee, declared his intent to push for both together while Democrats still control both chambers of Congress.

Democratic Sen. Sherrod Brown, chair of the Senate banking committee, has stated that expanding the CTC is his top priority. “I’ll put it this way, no more tax breaks for big corporations and the wealthy unless the child tax credit’s with it. I’ll lay down in front of a bulldozer on that one,” he said in September.

Additional aid for Ukraine, public health, and disaster relief are the Biden administration’s top priorities for any end-of-year deal, but in late November, Karine Jean-Pierre, the White House press secretary, said that if corporate tax breaks are included in a final deal, tax cuts “for working families” should be as well.

The negotiations ultimately may turn on just how much corporate lobbying pressure Republican lawmakers face. Prior to the midterms, Republicans anticipated much bigger electoral gains, making compromise with Democrats ahead of the new Congress seem less urgent. But now, with Democrats set to retain Senate control and Republican House margins tighter than expected, the expectation that Republicans would even be able to reach a deal on the business tax breaks next year if they wanted to looks dicey.

This reality, in fact, partly explains why Senate Republican leader Mitch McConnell announced last week that he’d like to negotiate an omnibus tax package in December, rather than a temporary spending deal that prevents a government shutdown but kicks the can on serious legislative decisions. Pushing the tax negotiations to 2023 would mean incoming House Speaker Kevin McCarthy, rather than current Speaker Nancy Pelosi, would be tasked with getting an acceptable deal through his chamber. “Nobody trusts McCarthy to pass anything (not even McCarthy),” quipped Politico in late November.

Though some advocates are still publicly calling for the expanded CTC of 2021, most acknowledge they’d accept more modest improvements

The 2021 expansion of the child tax credit, passed as part of President Joe Biden’s pandemic relief program, sent thousands of dollars to parents across the US. It made non-working and poor families fully eligible for the credit’s full value and increased the value of the subsidy itself — up to $3,600 per child.

Democrats had been optimistic that if they could just seed the generous program through the American Rescue Plan, then they would amass the kind of political support that makes a popular subsidy hard to repeal. But they failed, and the CTC is resultantly back to its pre-Covid form, with a maximum of $2,000 per child for working families only — and will remain there unless lawmakers change it.

Kevin Dietsch/Getty Images

Democratic Sen. Joe Manchin and Republicans believe it’s important for the child tax credit to maintain a connection to working parents.

At the heart of ongoing debates over the CTC are unsettled questions about what the policy is for. Is it to reduce childhood poverty? Is it to incentivize parents to work? Is it to help all kids?

Some Democratic lawmakers and CTC activists have been publicly calling for a reinstatement of the 2021 child tax credit, pointing to the research showing it helped families, reduced child poverty, and did not deter parents from working.

In late October, dozens of centrist Democratic lawmakers sent a letter to House leadership calling for an extension of the CTC passed under the American Rescue Plan. Theirs was followed by a similar letter, making the same ask, signed by dozens of progressive Democratic lawmakers. Another letter in November signed by over 550 hunger groups likewise called on congressional leadership to reinstate the child tax credit from 2021.

Adam Ruben, the director of Economic Security Project Action, a group organizing for the CTC, told me that advocates both in Congress and outside Capitol Hill are “crystal clear and aligned” in calling for the child tax credit that passed the House as part of their Build Back Better package, which mirrored the American Rescue Plan version. “That’s the version that’s most effective at reducing poverty, most effective at helping families with the high cost of gas and groceries,” he said.

Yet privately, most child tax credit champions admit they’d accept something less generous than the American Rescue Plan version, and in lobbying meetings they aren’t pressing lawmakers to hold the line, as they did during the reconciliation process. Even some lawmakers and advocates are saying this now publicly.

One option to expand the credit is to focus on the 19 million children under age 17 who currently receive less than the full $2,000, either because their parents earn too little to qualify or because they aren’t working at all. (These children are disproportionately Black, Latino, American Indian, or Alaska Native.)

Expanding the credit for those 19 million children — or, as policymakers say, making the credit “fully refundable” — would cost about $12 billion per year. But it’s not really the cost, advocates acknowledge, that’s the barrier to doing that. It’s that Manchin and Republicans believe it’s important for the credit to maintain some connection to working parents.

As a compromise, Democratic aides say they’re hoping they could make the credit at least fully refundable for parents of young children, or lower the amount parents need to earn to qualify for the credit’s full value.

“I have always believed that in the end this would be bipartisan, that it wouldn’t be just the way I had designed it, that the Republicans would make some changes to it,” Democratic Sen. Michael Bennet said recently on a Politico podcast.

Elyssa Schmier, a lobbyist with MomsRising, told me that while their long-term goal is to see a permanent extension of the child tax credit passed under the American Rescue Plan, what they’re hoping to see in a lame-duck deal “is first and foremost the inclusion of the child tax credit” and in a form that helps it reach as many families in need as possible. Schmier said their focus is not on increasing the value of the credit right now, but expanding it for low-income families currently barred by work requirements.

Rev. Jim Wallis, another child tax credit advocate who leads the Georgetown University Center on Faith and Justice, said he’s not expecting lawmakers to approve a permanent end to all work requirements in December, and said advocates are pushing for some kind of “expansion” targeted specifically to the poorest and most vulnerable families.

Most liberal activists right now agree with Schmier and Wallis that focusing on the credit’s anti-poverty potential is the most important piece. Other coalition letters have been careful to exclude mention of the 2021 child tax credit, so as to not imply they’re demanding the same policy they were calling for earlier this year. One congressional letter sent by five national civil rights organizations simply called to “expand the CTC,” as did another sent by a coalition of Christian churches and ministries.

The money elephant in the room

One reason many Democrats are trying to minimize discussion of the 2021 expanded child tax credit now is because it — and the version Democrats passed in their subsequent House Build Back Better package — is very expensive, with a price tag exceeding more than $100 billion per year.

In comparison, the corporate tax breaks with which advocates are hoping to pair a child tax credit expansion come at a lower cost. Estimates vary, but the ballpark figure floating around the Senate is somewhere between $45 billion and $60 billion per year. The Committee for a Responsible Federal Budget has estimated that a permanent R&D fix would cost roughly $155 billion over the next 10 years.

J. Scott Applewhite/AP

Senate Minority Leader Mitch McConnell has insisted that any end-of-year tax deal must prioritize defense spending over domestic policies like the child tax credit.

“I love the CTC, but I think advocates have done a terrible job of acting like it costs peanuts,” said one Democratic aide working on the negotiations. “It gets you nowhere to pretend we can do this massive transformational thing for nothing. Like expectations here have just been so out of whack because none of the advocates would admit this massive expansion of child benefits costs a lot of money.”

Rather than focus on comparing dollar amounts between the child tax credit and the business tax breaks, CTC advocates have stressed lawmakers should focus instead on parity of time for benefits. In other words, if Congress extends R&D tax breaks for another two years, then they should extend the child tax credit in some form for two years, too. A spokesperson for the Chamber of Commerce declined to comment.

For now, Democratic aides say they’re waiting to hear more details from Senate leadership over how much money is on the table to work with at all. McConnell has previously insisted that any end-of-year tax deal must prioritize defense spending over domestic policies, given that Democrats have already passed major domestic policy bills this year, though Senate Majority Leader Chuck Schumer said he intends to fight this.

One crucial factor, according to Senate aides, will be if Republicans feel like they’re getting a fair trade — something that can be measured in terms of dollar amount, length of time, or even, frankly, just “vibes.” When House lawmakers first sent their letters in late October and early November calling for a reinstatement of the 2021 expanded CTC in exchange for business tax breaks, some Republican staffers felt Democrats were not making a serious offer, given that many Democrats also want the R&D credits extended. In other words, since Democrats weren’t coming out of the gate with any proposed cuts to their own priorities, it didn’t seem like a great deal to Republicans, or even a realistic threat.

Democratic aides I spoke with said the threat to vote against R&D tax breaks if not paired with the child tax credit is no bluff, and pointed to the fact that Democrats have stood resolved against approving the business tax breaks to this point despite intense lobbying pressure. “If the number of Democrats willing to support the Young-Hassan bill were compelling then this would have been passed by now,” one aide said, referring to a bill Sens. Todd Young (R-IN) and Maggie Hassan (D-NH) have tried to include in multiple legislative vehicles this past year.

Sam Hammond, the director of social policy at the Niskanen Center, a centrist think tank, thinks the chances of reaching a deal on the child tax credit this month are relatively slim, though he believes the results of the midterms increased its odds. “Even though Democrats lost the House, just having control of the Senate floor is, like, nine-tenths of the battle over what can be put on the floor and up for a vote,” he said. “I think if Republicans had swept, there wouldn’t be a tax package being discussed at all.”

Where are Republicans on this?

Conservatives opposed to expanding the child tax credit are sensing that a legislative deal might not be far-fetched, and have started to ramp up their opposition.

The Wall Street Journal ran an op-ed and an editorial against the CTC in late November, perhaps the clearest indication they recognize it’s time to fight. “The tax credit is a parable about good intentions, unintended consequences, and the insatiable entitlement state,” the Journal argued, citing new studies that estimate a permanent extension of the American Rescue Plan child tax credit would reduce economic output by 0.2 percent over a decade, and lead to 1.5 million people leaving the workforce.

In June, Republican Sens. Mitt Romney (UT), Richard Burr (NC), and Steve Daines (MT) introduced a new bill — the Family Security Act 2.0 — to distribute monthly cash payments to parents. The proposal is a modified version of a child allowance policy Romney introduced in 2021, though his new bill includes a requirement that families earn at least $10,000 to receive its full benefit.

The Republican proposal would mark a big expansion from the current child tax credit. It would increase the maximum value from $2,000 to $4,200 for each child under age 6 and $3,000 for each child ages 6 through 17, paid out in monthly installments.

Romney’s office declined to comment for this story, but the Utah senator told Semafor “it’s probably not going to be until next year that we consider new legislation” on the CTC.

Most other Republicans, though, are being more tight-lipped, and Ruben, of the Economic Security Project, says his conversations with Republicans suggest they’re keeping their negotiating options open for now.

“We’re talking to Republican offices that say they want to do more for families than current law provides, and when we say, ‘What’s your bottom line in terms of what you can or can’t accept?’ they say, ‘Well, I don’t know, it’s a deal,’” Ruben said. “They don’t say, ‘It has to absolutely do this,’ or has to be written in a certain way. It’s all more fluid in Congress right now than that.”